Raher Reply Comments to Fcc on Wright Petition Phone Justice 4-22-13

Download original document:

Document text

Document text

This text is machine-read, and may contain errors. Check the original document to verify accuracy.

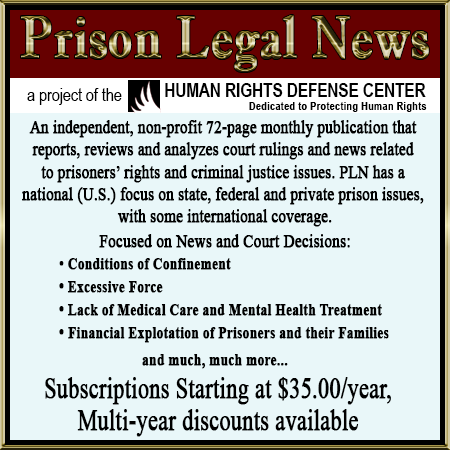

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, DC 20554 In the Matter of: Rates for Interstate Inmate Calling Services WC Docket No. 12-375 REPLY COMMENTS OF STEPHEN A. RAHER Stephen A. Raher 1120 NW Couch St., 10th Floor Portland, OR 97209 (503) 727-2163 Dated: April 22, 2013 TABLE OF CONTENTS Page I. The ICS Market is Oligopolistic and Anti-Competitive .................................................... 1 A. The ICS Market is Dominated by a Small Handful of Firms ................................ 2 B. Market Concentration, Combined with the Structure of the Industry, Indicates the Occurrence of a Market Failure ........................................................ 3 C. II. III. IV. 1. Barriers to Entry ......................................................................................... 3 2. Successful Bidders Enjoy Monopoly Power.............................................. 4 Competition in Procurement Should not be Confused with a Competitive Market for Purposes of Rate-Setting...................................................................... 5 The Commission’s Regulatory Jurisdiction is Clear ......................................................... 7 A. The Market Failure in the ICS Industry Supports the Need for Rate Regulation .............................................................................................................. 7 B. The Commission’s Historical Hands-off Approach to ICS Must be Reconsidered in Light of Technological Changes ................................................. 8 C. The Commission Should Regulate Ancillary Fees ................................................ 9 Opponents of Rate Regulation Have Not Produced Useful Cost Data ............................ 10 A. The Majority of ICS Providers Have Flatly Refused to Provide Cost Information .......................................................................................................... 10 B. Securus’s Cost Evidence is Not Reliable ............................................................. 12 C. Per-Call and Per-Minute Charges ........................................................................ 14 Conclusion ....................................................................................................................... 15 -i- SUMMARY The comments filed in this proceeding further support the need for quick action by the Commission to regulate ICS rates. In particular, horizontal mergers and technological changes in the ICS industry have accentuated the need for rate regulation while also solidifying the Commission’s jurisdiction to impose rate caps. While the Petitioners and other interested parties have provided strong legal and factual arguments in support of rate regulation, ICS providers have ignored the Commission’s repeated requests for updated cost information, instead choosing to make vague security-related arguments without quantitative substantiation. All available evidence points to supracompetitive ICS rates, and if providers wish to defend their pricing, they should do so in the context of a formal rate-setting procedure. -i- Before the FEDERAL COMMUNICATIONS COMMISSION Washington, DC 20554 In the Matter of: WC Docket No. 12-375 Rates for Interstate Inmate Calling Services REPLY COMMENTS OF STEPHEN A. RAHER The comments submitted by interested parties in the above-captioned proceeding provide further evidence of the need for rate regulation, and lend considerable support to the proposal outlined in the undersigned’s initial comments filed on March 25, 2013 (the “Raher Comments”). This reply is submitted to address three themes reflected in other parties’ comments. First, the comments indicate that the ICS market is not competitive and is dominated by a small handful of firms. Second, because of the market failure in the ICS industry, the Commission has clear jurisdiction to regulate rates. Finally, despite the Commission’s express request for evidence concerning ICS costs, providers have failed to provide such data in a useful format. I. The ICS Market is Oligopolistic and Anti-Competitive Supporters of the ICS status quo contend that the Commission should refrain from regulating rates and instead trust that ill-defined “market forces” will militate reasonable rates.1 This attempt to vitiate the Commission’s regulatory powers must be rejected for two reasons. First, the ICS market is not efficient because it is dominated by three firms. Second, ICS providers enjoy monopoly pricing power and what little competition exists is not structured so as 1 Comments of Global Tel*Link (hereinafter “GTL Comments”) at 19. -1- to achieve just and reasonable rates in compliance with section 201 of the Telecommunications Act (the “Act”). A. The ICS Market is Dominated by a Small Handful of Firms Martha Wright, the other petitioners, and certain advocacy groups (collectively, the “Petitioners”) provide strong support for the Alternative Wright Petition in their thorough and informative comments. Among the issues that the Petitioners address is the rapid and pervasive consolidation among ICS providers.2 This series of horizontal mergers provides further support for price regulation. Because of the relatively small number of market participants and the public nature of the providers’ pricing, the likelihood of tacit price collusion is enhanced. As evidenced by the study submitted by the Human Rights Defense Center (“HRDC”), ICS rates are publicly available through federal and state open records laws.3 While this is helpful for purposes of policymaking, it also raises the possibility that dominant carriers can, in the process of bidding for contracts, tacitly coordinate to set anti-competitive prices without resorting to express collusion.4 Concentration in the ICS market is reflected in the comments of a wide range of parties. Most tellingly, the ICS providers’ own comments demonstrate the thinness of the market. Global Tel*Link (“GTL”) states that it serves “more than 1,900 correctional facilities.”5 Meanwhile, Securus Technologies, Inc. (“Securus”) says that it serves “roughly 2,200 facility locations.”6 In the most recent year for which comprehensive data is available, there were 3,283 jails and 1,821 prisons in the United States, for a total of 5,104 correctional facilities.7 Thus, using GTL and Securus’s own figures, these two firms hold exclusive contracts for 80% of the 2 Comments of Martha Wright, et al. (hereinafter “Petitioners’ Comments”) at 18-19. See also GTL Comments at 27. 4 See generally Dennis A. Yao & Susan S. DeSanti, Game Theory and the Legal Analysis of Tacit Collusion, 38 Antitrust Bull. 113 (1993). 5 GTL Comments at 3. 6 Amended Declaration of Curtis L. Hopfinger (hereinafter “Hopfinger Decl.”) ¶ 3. 7 U.S. Dept. of Justice, Bureau of Justice Statistics, Census of Jail Facilities, 2006, NCJ No. 230188 (Dec. 2011) tbl. 1; U.S. Dept. of Justice, Bureau of Justice Statistics, Census of State and Federal Correctional Facilities, 2005, NCJ No. 222182 (Oct. 2008) at 1. 3 -2- country’s correctional facilities. In line with this estimate, the Petitioners report that GTL and Securus “control[] more than 70% of the estimated $1.2 billion annual market.”8 And data submitted by HRDC shows that among state departments of corrections, three firms (GTL, Securus, and CenturyLink) hold contracts covering 88% of state systems.9 No matter what metric is used, the inescapable fact is that GTL and Securus dominate the market, and once CenturyLink is added, the concentration is even more pronounced. The combined effects of market concentration and the other factors discussed in the following section indicate the need for price regulation. B. Market Concentration, Combined with the Structure of the Industry, Indicates the Occurrence of a Market Failure As noted above, the ICS market is dominated by three firms, two of which (GTL and Securus) control the vast majority of the market. The dominant firms attempt to paint a picture of competition by referencing other, smaller, competitors. For example, Securus references unnamed “five to seven” companies that “generally” or “usually” bid on ICS contracts.10 Although there are other firms in the industry, this does not make for a functional market. The presence of a “competitive fringe” does not overcome the anti-competitive effects of market concentration.11 Instead, the Commission must consider the totality of market economics when determining if a market failure has occurred. Specifically, two factors are deserving of close attention: barriers to entry and monopoly pricing power of successful bidders. 1. Barriers to Entry The ICS providers spill considerable ink cataloging the supposedly expensive technology they must deploy as part of their operations.12 As discussed below (in section III), there are 8 Petitioners’ Comments at 19. Comments of Human Rights Defense Center (hereinafter “HRDC Comments”) at 17-18. 10 Hopfinger Decl. ¶ 4. 11 IIB Phillip E. Areeda, et al., Antitrust Law: An Analysis of Antitrust Principles and Their Application (3d ed. 2007) ¶ 404a (“An oligopoly market is one in which a few relatively large sellers account for the bulk of the output. It may include a ‘competitive fringe’ of numerous smaller sellers who behave competitively because each is too small individually to affect market prices of output.”). 9 -3- reasons to question the veracity of these claims. However, the ICS providers cannot have their cake and eat it too—if the technology necessary to provide inmate calling services is as costly as the providers would have the Commission believe, then the two dominant carriers have a formidable advantage (being able to allocate these fixed costs among a large base of callers), and new competitors face prohibitive barriers to entering the market. Even if providers’ financial costs are exaggerated (as they may well be), the technology necessary to provide specialized security features in the ICS environment nonetheless appears to require either research and development, capital outlays, and/or licensing fees (if patent holders are willing to license their inventions)—all of which constitute barriers to entry, even if quantitative information regarding these expenses is lacking.13 Indeed, GTL appears to acknowledge these barriers when it admits “because GTL is one of the largest providers in the market, it has economies of scale and efficiency that enable it to pay high commissions, provide high-quality service, and still charge lower rates than many other ICS vendors.”14 Importantly, GTL’s claim that its economies of scale enable it to charge lower rates than some of its competitors, does not mean that GTL’s rates are reasonable.15 2. Successful Bidders Enjoy Monopoly Power Once an ICS bidder wins an exclusive contract from a correctional authority, the firm enjoys the power of a monopoly provider, because end users are unable to select alternative suppliers.16 CenturyLink denies the monopoly nature of ICS contracts,17 but this reasoning is refuted not only by common sense but by the comments of GTL, which analogizes site 12 GTL Comments at 6-10; Comments of Securus Technologies, Inc. (hereinafter “Securus Comments”) at 3-5; Comments of CenturyLink (hereinafter “CenturyLink Comments”) at 7-9. 13 See Image Tech. Servs. v. Eastman Kodak Co., 125 F.3d 1195, 1208 (9th Cir. 1997) (“Common entry barriers include: parents or other legal licenses, control of essential or superior resources, entrenched buyer preferences, high capital entry costs and economies of scale.”) 14 GTL Comments at 13. 15 Similarly, Securus’s claim that rates are “decreasing steadily” (Comments at 5-6) does not mean that rates have decreased to a just and reasonable level. 16 Declaration of Coleman Bazelon (hereinafter “Bazelon Decl.”) ¶ 7. 17 CenturyLink Comments at 5, n. 12. -4- commissions to fees paid for the privilege of receiving a sanctioned monopoly, such as a restaurant concession at an airport.18 American law has long recognized the importance of regulating prices charged by monopolist utilities. ICS providers are entitled to earn a reasonable rate of return—and notwithstanding the providers’ defensive comments, no other parties seriously dispute this. Yet at the same time, a “public utility . . . has no constitutional right to profits such as are realized or anticipated in highly profitable enterprises or speculative ventures.”19 Despite the widespread deregulation of rates under the Telecommunications Act of 1996, ICS providers maintain a peculiar role as uniquely public utilities: they receive a state-sanctioned monopoly bestowed by an executive agency and their customer base consists of callers committed to the custody of public correctional authorities.20 Thus, it is not improper, unusual, or arbitrary for the Commission to regulate ICS rates under sections 201 and 276 of the Act. C. Competition in Procurement Should not be Confused with a Competitive Market for Purposes of Rate-Setting The ICS providers generally oppose rate regulation because they assert that competition among providers for exclusive contracts is sufficient to overcome any market failures.21 This argument is flawed for three reasons. First, the ICS providers persist in citing outdated Commission findings that have been superseded by the record developed in the many years during which the Wright Petition has been pending. Securus argues that the Commission’s 1996 detarrifing order (which did not specifically address inmate services) should prevent ICS rate regulation.22 GTL advances a similar theory based on language in the First Payphone Order.23 Both providers argue that the 18 GTL Comments at 13. Bluefield Waterworks & Improvement Co. v. Pub. Serv. Comm’n of West Virginia, 262 U.S. 679, 692-693 (1923). 20 Even inmates housed in privately operated facilities are sent to these institutions by the public authority to which they are remanded to serve their sentence or await trial. 21 Securus Comments at 1-2; GTL Comments at 14; CenturyLink Comments at 4. 22 Securus Comments at 15. 23 GTL Comments at 14. 19 -5- Commission should defer to correctional administrators’ evaluations of ICS rates. This argument ignores the Commission’s subsequent finding (which has not been contradicted by any evidence produced in this proceeding) that procurement processes in site-commission jurisdictions are likely to drive prices up because of the inherent conflict of interest that arises when the agency awarding the contract receives a profit interest in telephone revenues.24 Indeed this conflict of interest is apparent in the comments of the Arizona Department of Corrections, which laments the prospect of having to “compete for scarce funding” if it loses site commission revenues.25 As stated in the Raher Comments, the uses to which site commission revenues are put are not relevant to this proceeding—the Commission should end prison systems’ coercive collection of revenue for non-communications purposes from users of the public switched telephone network. Moreover, because no commenters have provided evidence rebutting the Commission’s previous conclusion regarding site commissions’ perverse impact on procurement, the bidding process in site-commission jurisdictions simply cannot be relied on to provide competitive rates for end users.26 A different concern arises in jurisdictions that do not have site commissions. Although end-user prices may be considered by procurement personnel, this is merely one of several factors on which a bid is scored. Thus, to say that procurement officials are focused on ensuring just and reasonable rates ignores the reality of the procurement process, in which administrators are interested in many non-price attributes of bids. Despite the hyperbolic parade of horribles raised by the ICS commenters, rate regulation such as that proposed in the Raher Comments would not prevent correctional administrators from awarding contracts based on security and other non-price factors. Rather, prison officials would still be free to select ICS providers based on correctional needs, while the Commission (possibly in conjunction with state regulators) 24 See NPRM ¶ 37. Comments of Arizona Dept. of Corr. at 1. 26 See also Bazelon Decl. ¶ 9. 25 -6- would then ensure that successful bidders charged rates that are reasonable in relation to the cost of providing these services. Finally, unlike a regulatory body, a procurement official does not have the power to compel accurate and uniform cost reporting. Nor is a procurement official likely to be trained in the nuances of regulatory economics. Thus, shifting responsibility for price oversight to prison administrators does nothing to discharge the Commission’s obligations under sections 201 and 276 to ensure reasonable rates and fair compensation. II. The Commission’s Regulatory Jurisdiction is Clear The vast majority of commenters have clearly articulated bases for the Commission to exercise jurisdiction over ICS rates and practices. In response, the ICS providers launch several self-serving arguments that are ultimately unpersuasive. The Commission possesses jurisdiction and should exercise its power to set rates and police predatory fees. A. The Market Failure in the ICS Industry Supports the Need for Rate Regulation As discussed above, the ICS market is not competitive. ICS providers seem to concede that rate regulation is appropriate in cases of market failures, but they refuse to acknowledge the problems in the industry as presently constituted. Securus, in particular, raises multiple straw man arguments, which the Commission should not be distracted by. Securus claims to acknowledge that “[t]he Commission . . . does not appear to be attempting to[] regulate the operations of any correctional facility,”27 yet its comments then proceed to caution about the danger of federal regulations that would interfere with prison operations. In furtherance of this argument, Securus cites two District Court cases that— contrary to Securus’s characterization—actually support the argument for the Commission’s jurisdiction. The court in Miranda v. Michigan28 dismissed the plaintiffs’ antitrust claims against ICS providers, and held that the Commission has primary jurisdiction over challenges to 27 28 Securus Comments at 8. 141 F.Supp.2d 747 (E.D. Mich. 2001). -7- ICS rates.29 Similarly, in McGuire v. Ameritech Services,30 the court dismissed plaintiffs’ constitutional and antitrust challenges to ICS rates, noting that “[r]ate setting and related relief is the bailiwick of the FCC.”31 The difference between the Miranda and McGuire cases and the present proceeding is important to keep in mind. Judicial refusal to intervene in prison operations based on an antitrust or constitutional cause of action has no bearing on the Commission, which has been given express regulatory jurisdiction over prison phones under section 276(d). Courts have recognized the Commission’s jurisdiction in this area,32 and the ICS providers have failed to show otherwise. Securus then argues that even if the Commission can regulate ICS rates, it should refrain from doing so unless “a demonstrable market failure has occurred.”33 Of course, for the reasons discussed above, and as further explained in the Bazelon Declaration, a market failure has clearly occurred the Commission is empowered to take action. B. The Commission’s Historical Hands-off Approach to ICS Must be Reconsidered in Light of Technological Changes ICS providers oppose rate regulation based primarily on blind adherence to the status quo. For example, GTL argues that “the historic regulation of prisons by the states and the unique challenges presented by state prisons and ICS, place regulation of ICS more appropriately with the states.”34 Setting aside the fact that ICS providers have advocated for federal regulation and preemption when it suits their purposes,35 GTL’s appeal to “historic” practices misinterprets the relevant history. 29 Id. at 758-759. 253 F.Supp.2d 988 (S.D. Ohio 2003) 31 Id. at 1014. 32 Petitioners’ Comments at 6-7. 33 Securus Comments at 14. 34 GTL Comments at 33. 35 See In the Matter of Implementation of the Pay Telephone Reclassification and Compensation Provisions of the Telecommunications Act of 1996, CC Docket No. 96-128, Petition for Partial Reconsideration and Clarification of Inmate Calling Services Providers Coalition (Oct. 21, 1996) at 6-11. 30 -8- Traditionally, inmate calling services were provided by local exchange carriers, which were regulated pursuant to the well-established principle that “when private property is affected with a public interest, it ceases to be juris private only.”36 Thus, the evolution of the modern ICS industry has only occurred since the breakup of AT&T.37 Notably, early deregulation of ICS occurred under the mantle of the Commission’s rulings concerning customer premises equipment (“CPE”). Thus, in the 1996 ruling that inmate telephones were CPE subject to the unbundling rules of Computer II and Tonka Tools, the Commission’s reasoning was premised on the fact that “inmate-only payphones” provided specialized features such as limiting calls to pre-approved numbers and monitoring calls for compliance with facility rules.38 Evolutions in the ICS industry now require the Commission to reconsider earlier rulings, in light of technological change. Because specialized ICS features are now generally deployed from a central office,39 prior rulings based on antiquated CPE rules should be reexamined. In addition, the wide variety among ICS rates revealed in the HRDC study suggests the presence of cross-subsidies between ratepayers in different jurisdictions. Because multiple correctional systems are now served by the same centralized equipment, it is critical that the costs associated with this central plant be fairly apportioned among customers, and the Commission should use its rate-setting power to accomplish this. C. The Commission Should Regulate Ancillary Fees The Petitioners’ discussion of ancillary fees is particularly instructive.40 Innovations in electronic payments have dramatically reduced costs of payment processing, but the fees reported by the Petitioners show that ICS providers exercise their monopoly power by charging 36 Munn v. Illinois, 94 U.S. 113, 126 (1876) Bazelon Decl. ¶ 8. 38 In the Matter of Petition for Declaratory Ruling by the Inmate Calling Services Providers Task Force, RM-8181, Declaratory Ruling, 11 FCC Rcd. 7362 (1996) ¶ 7. 39 Petitioners’ Comments at 17-18; Securus Comments 4; Comments of Pay Tel Comm’cns (hereinafter “Pay Tel Comments”) at 13. 40 Petitioners’ Comments at 24-27. 37 -9- predatory fees that cannot possibly represent actual costs. The Commission should address these unfair practices as part of this proceeding. III. Opponents of Rate Regulation Have Not Produced Useful Cost Data The Commission expressly sought updated information concerning ICS providers’ costs.41 Because no ICS providers have submitted meaningful cost data as part of this proceeding, the Commission has no alternative but to obtain such data through proceedings to determine rate caps and/or set individual provider rates. A. The Majority of ICS Providers Have Flatly Refused to Provide Cost Information Despite the Commission’s clear desire to obtain reliable cost information, most ICS providers simply refused to provide any salient data. For example, CenturyLink devotes much of its comments to a discussion of ICS costs, but it speaks of these costs only in general terms, without ever revealing useful quantitative data about specific expenses.42 GTL, meanwhile, declines to provide any cost information because doing so would supposedly be difficult.43 Yet GTL then proceeds to criticize the ICS Provider Proposal for reporting costs based on too small of a sample.44 Although there are methodological problems (including small sample size) with the ICS Provider Proposal, GTL’s criticism—along with its refusal to provide more accurate data—shows that the Commission will never obtain reliable cost information through voluntary reporting by ICS providers. Although GTL does not reveal quantitative information about its costs, it is more than happy to provide lengthy anecdotal discussions. Because of the lack of details, the Commission should disregard GTL’s references to its costs. GTL expounds at length about the “complex and costly technological features” that are necessary in an ICS environment, yet it assiduously avoids quantifying the costs of these features. 41 NPRM ¶ 25. CenturyLink Comments at 6-10. 43 GTL Comments at 26. 44 Id. at 29. 42 - 10 - One of the only times GTL provides any kind of specificity is when it discusses the longterm storage of audio recordings of inmate calls. When discussing its California DOC contract, GTL states that it is required to store seven years’ worth of recordings, “which amounts to approximately 160 terabytes of data.”45 Although GTL provides a footnote explaining how much information can be stored on 160 terabytes of disk space, it never provides a cost for this disk space, perhaps because such cost may not be particularly high. If seven years’ of California recordings occupies 160 terabytes, this equates to annual storage requirements of 23 terabytes. Retail pricing for hard drives indicates current prices ranging from $40-70 per terabyte,46 which would equate to an annual cost of roughly $1,600. Alternatively, prices for online “cloud” storage reveal higher costs—for example, retail pricing for Google’s cloud storage would be roughly $19,200 annually for 23 terabytes.47 Yet, given California’s current in-state prison population of 132,660,48 even the more expensive cloud-storage pricing would result in annual costs of only 14 cents per inmate. Perhaps neither of the aforementioned prices are accurate proxies for GTL’s actual storage costs, but the point is that GTL’s refusal to provide relevant data for the record leaves interested parties no choice but to use imprecise substitutes when trying to determine ICS provider costs. Because GTL has failed to substantiate its claims of “complex and costly” technology, the Commission should not give weight to its arguments. GTL and CenturyLink both use faulty logic when attacking the Petitioners’ proposal for rate caps. Both commenters make the accurate statement that prison security needs vary across facilities.49 But the commenters then go on to imply that these varying general security needs translate into highly variable phone security needs. This is not necessarily the case. For 45 Id. at 9. See CNET.com representative prices for hard drives, available at http://www.webcitation.org/6G3Z69TfQ 47 See Google Cloud Storage Pricing and Support, available at https://developers.google.com/ storage/docs/pricingandterms (last visited Apr. 21, 2013). 48 Calif. Dept. of Corr. & Rehabilitation, Weekly Report of Population (Apr. 10, 2013), available at http://www.cdcr.ca.gov/Reports_Research/Offender_Information_Services_Branch/ WeeklyWed/TPOP1A/TPOP1Ad130410.pdf. 49 GTL Comments at 7-8; CenturyLink Comments at 7-8. 46 - 11 - example, just because two different prisons house inmates of different security levels does not mean that both facilities would not require inmate calls to be verified against a list of allowed call recipients. The only specific variable cited by GTL is the need to have more telephones in high security facilities,50 however GTL does not provide any information on the comparative cost of end-user telephone hardware versus cost of central office equipment. Smaller ICS providers also generally decline to reveal salient cost information. Pay Tel, for example, offers the 2008 Wood Study as evidence of provider costs, while simultaneously listing four ways in which the data in the Wood Study have been rendered obsolete by changes in the industry.51 Commenter TurnKey Corrections makes no mention of costs.52 Network Communications International Corporation (“NCIC”) does provide some isolated examples of costs,53 however this information is of limited utility because of the comments’ piecemeal approach to the overall cost structure. Moreover, because of NCIC’s market share appears to be quite small, it is unclear whether the costs it cites are representative of the costs incurred by dominant ICS firms. The ICS providers’ discussion of security features all miss the critical point of this proceeding. The question is not whether prisons should be allowed to employ necessary security features—no one has disputed this. The issue is whether the cost of these features can be taken into account by the Commission in setting ICS rates. These costs can be incorporated into rate caps, and opponents of rate regulation have not shown otherwise. B. Securus’s Cost Evidence is Not Reliable Securus is the only ICS provider that submitted cost evidence, in the form of an expert report by economist Stephen Siwek (the “Siwek Report”). Although the Siwek Report does provide some insight into Securus’ costs, it suffers from grave methodological flaws which severely limit the usefulness of the reported data. 50 GTL Comments, at 8. Pay Tel Comments at 11-14. 52 Comments of TurnKey Corrections. 53 Comments of Network Comm’cns Int’l Corp. at 4-7. 51 - 12 - Specifically, the Siwek Report selectively presents data from only a portion of Securus’s facilities. Not only does this present an incomplete picture of Securus’s cost structure (thereby raising questions of cross-subsidies), but the way in which the facilities were selected leads to concerns about the reliability of the data. Mr. Siwek reports data in four categories: three jail groups and one prison group. The jail groups each consist of ten facilities, selected by call volume. The prison group, in contrast, is not based on facilities, but rather contains all of Securus’s state department of corrections systems (most if not all of which presumably consist of multiple facilities). Accordingly, the four categories Mr. Siwek uses to report cost data are not comprised of like-kind components. In addition, Mr. Siwek’s attempts to paint a picture of highly variable costs across facility types is belied by his own evidence. Given similarities in facility size, one would expect costs of ICS services in prisons to be roughly comparable to costs in large jail systems. At first glance, the Siwek Report appears to show quite different costs for prisons as opposed to large jails: 17.48 cents per minute for large jails, versus 10.69 cents per minute for prisons.54 Yet, these cost figures include site commissions. Once site commissions are subtracted, costs for large jails and prisons are both 4.3 cents per minute, as shown in the following table: Modified ICS Costs Category High 10 Medium 10 Low 10 State DOC ICS Costs* 1,759,901 34,258 2,207 4,605,001 Site Comm'n** 1,326,530 23,098 409 2,730,105 Costs Net Site Comm'n 433,371 11,160 1,798 1,874,896 Total Minutes* 10,068,670 68,403 1,290 43,083,108 Average Costs/Min 0.0430 0.1632 1.3938 0.0435 * Siwek Report, tbl. 2 ** Siwek Report, tbl. 5 This similarity of costs in high-volume facilities supports the tiered rate-cap approach that was proposed in the Raher Comments. The inclusion of site commissions also calls into question the reliability of the data presented in the Siwek Report. 54 Siwek Report ¶ 3.1. - 13 - C. Per-Call and Per-Minute Charges ICS providers argue that they must be able to charge a per-call fee because so many of their costs are fixed.55 Indeed, provider comments indicate that the cost of most security features does not vary with call length. To the extent that this is true, then per-minute charges should be close to market-rate, since ICS providers do not appear to incur specialized costs for per-minute long distance network access. Indeed, the only variable costs appear to be storage of audio recordings (likely a small cost, as discussed above in section III.A) and bad debt (which would not be applicable for debit or prepaid calling). As shown by the HRDC study, per-minute rates dramatically exceed prices for non-ICS long distance, further strengthening the case for rate regulation. The other important issue relating to per-call fees is the matter of dropped or disconnected calls.56 Commenters, including numerous inmate callers and call recipients, have provided substantial evidence of the problems associated with dropped calls. In response, ICS providers attempt to shift blame to customers, alleging that calls are only dropped for legitimate security reasons. For example, Securus claims that “the overwhelming majority of allegations of unwarranted ‘dropped calls’ are found to be false.”57 Not only does this conclusory allegation fail to provide data or information on the accessibility or accuracy of Securus’s customer complaint resolution process, but it is also belied by the comments of ICS provider GTL. According to GTL, security mechanisms can mistakenly disconnect a call if there is background noise or static or if the recipient is using a cordless phone.58 This clearly points to the likelihood of “false positive” disconnections, which are triggered not by nefarious criminal activity, but by benign factors such as static. Worse yet, GTL tries unconvincingly to analogize these security features to requiring prison visitors to pass through a metal detector.59 The weakness of this 55 Securus Comments at 16-18; CenturyLink Comments at 7-9. Petitioners’ Comments at 24-25; HRDC Comments at 11. 57 Hopfinger Decl. ¶ 35. 58 GTL Comments at 30. 59 Id. 56 - 14 - analogy should be obvious: although a metal detector may be subject to false positives (e.g., an alarm caused by a harmless object like pocket change), visitors who trigger such false positives are not financially penalized. In contrast, a call recipient whose line is susceptible to ambient noise may be subject to multiple connection fees even though the call poses no actual security threat. IV. Conclusion The Petitioners and other commenters who support ICS rate reform have thoughtfully considered the questions posed in the Notice of Proposed Rulemaking and have provided the Commission with a record that establishes a basis for rate regulation. ICS providers and correctional administrators who do not want to lose site commission revenue have responded with arguments that are not supported by facts or law. Accordingly, the Commission should exercise its jurisdiction under sections 201 and 276 of the Act, and should implement a regulatory regime consistent with the system proposed in the Raher Comments. Respectfully submitted, /s/ Stephen A. Raher Stephen A. Raher 1120 NW Couch St., 10th Floor Portland, OR 97209 (503) 727-2163 - 15 -