Study Examines Link Between Fines and Crime

by Jayson Hawkins

A new study published in the American Sociological Review (“ASR”) challenges the efficacy and rationale of the growing body of fees and fines being imposed for minor offenses in courts across the U.S. The study asserts that these fines have no deterrent value and simply punish, or even criminalize, poverty.

Fines have been part of the Western system of justice since well before the dawn of recorded history. Celtic and Germanic customs included payment of financial compensation for a wide range of offenses, including homicide. This compensation (Celtic “Earic” and Germanic “Weregild”) was enshrined in early legal codes, and just as people of higher status garnered a higher blood price, so, too, were the wealthy more likely to have the resources to pay that price and avoid the harsher consequences faced by the poor. As Europe moved toward modernity, blood-money systems were abandoned in favor of more contemporary forms. These changes were rooted in concepts of state-sponsored retributive justice as well as ideals of equal treatment before the law regardless of one’s finances.

Fines, however, never disappeared, especially for low-level offenses. As the anti-tax movement gained momentum in the early 1980s, the impetus for levying fines changed in the face of a combination of budget cuts and a simultaneous expansion of the role of criminal justice systems in late twentieth century America. The result has been a growing proliferation of fines and fees associated with interaction with the criminal justice system. Advocates for these new fines claim that the levies act as a deterrent and shift the costs of criminal justice from the public to criminals themselves.

The ascendancy of this argument has led to a vast system of fines and fees. Nationwide, the percentage of people in state prisons subject to fines or fees grew from 24% in 1991 to 66% by 2004. Failure to pay fees can result in imprisonment in 47 states. The costs levied on prisoners regularly run thousands of dollars, even for relatively minor legal infractions.

Opponents of these practices argue that these fines and fees are totally ineffective tools for deterrence or raising revenue but rather serve to criminalize poverty. A series of studies over the last few decades have presented an ideological challenge to the pervasive growth of criminal justice fines and fees. These challenges are based on a concept of criminalization that sees crimes as “‘crimes’ are not self- evident types of human behavior but are instead the active products of state-sponsored efforts at enforcement, surveillance, labeling, and punishment (Jenness 2004).” Critics of the growth of fines assert that these new costs function to further marginalize the poor and extract resources from these marginalized communities to fund the institutions of oppression.

The links between poverty and criminalization flow along two paths: First, research has shown fees and fines generate anxiety, stress, and financial hardships that make criminal behavior more likely. Secondly, these debts often generate a response from the courts when defendants fail to pay. Even when poverty, homelessness, or mental illness are factors, failure to pay can generate warrants or referral to debt collectors, both of which result in further entanglement with the criminal justice system.

Several solutions have been put forward to address the problematic cycle of criminalization. The relief of legal debts for low-level offenses should alleviate social strain and thus lead to fewer rearrests. Opponents of this idea point to the deterrent effect of these fines. If they are correct, debt relief would lead to more recidivism. Another possibility is restraints put on collection efforts or punitive coercion by the courts to force payment. These efforts vary greatly across jurisdictions already, ranging from the criminalization of non-payment, to referrals to private debt collectors, to no effort at all.

The study published by the ASR explores the possibility of debt relief for people convicted of misdemeanors in Oklahoma County, Oklahoma. The study’s authors recruited 606 individuals. At the request of the prosecutors’ office, people convicted of driving-under-the-influence or domestic violence were excluded from the sample. The treatment group had 295 participants randomly assigned to it, and 311 were assigned to the control group.

For people in the treatment group, all current and prior fines and fees owed in Oklahoma County were paid. If a participant had probation, those fees were also paid, but the participant still had to comply with all other conditions of probation. The average amount owed in Oklahoma County by those in the treatment group was $2,920. The study did not pay court ordered restitution or debts to any other jurisdiction.

To discover the possible effects of other variables, the researchers surveyed participants in both the treatment and control groups. The survey examined demographics, socioeconomic characteristics, and criminal history. The results of this survey showed that in nearly all categories, all participants were close to the group mean. This consistency allows the conclusions drawn from study data to be given greater weight because the likelihood of a hidden variable skewing the data is small.

The results of the study examine the effects of debt relief. Over the first three months of the project, the treatment group was half as likely to be charged with a new offense than those whose fines were not paid. Over the course of a year, this gap narrows to almost zero. Conviction rates and jail booking rates followed a similar curve. These results suggest that fee relief reduces criminal behavior over the first few months, but over the longer term, relief neither contributes to crime nor has a measurable deterrent effect.

In terms of revenue recovery, participants in the control group who made any payment at all typically did so in the first six months. Only 11% paid an amount over the year that amounted to a tenth of their debt, and barely 50% paid an equivalent of one year’s worth of a payment plan, roughly $300. Considering that the average amount owed in the control group was $2,880 after one year, the study shows that using fines and fees as a means to generate revenue is extraordinarily inefficient.

This inefficiency did not stop Oklahoma County courts from referring the control group participants to private debt collectors; 20% of the control group had their debt referred to a private collector, though such referrals had no significant impact on payment.

Results in the treatment group varied across race, employment status, and the presence of substance abuse issues. Participants who self-reported drug or alcohol problems saw results that did not show significant variation from the treatment group as a whole. Differences did emerge, however, when participants were compared by employment status and race. Jobless participants were nearly twice as likely to be arrested as the employed but only 5% more likely to be convicted of any offense. Sorting the treatment group by race revealed that while non-whites were more likely to be rearrested and convicted than whites over the course of the study, the difference between the two groups was similar to that found in the control group. This means that while the court system seems to function unjustly, the treatment effect of debt relief was similar across racial lines.

The study results appear likely to generalize to other jurisdictions, but it is difficult to estimate the full effect in jurisdictions with more punitive policies regarding court debt. In places that impose fees more widely and jail for failure to pay, court debt relief might well have more measurable effects over the long term.

The authors of the study are confident the results “provide strong evidence for how fines and fees contribute to a criminalization of poverty, and they help specify how poor people become subject to enduring criminal justice control.” Fines act to create social strain that leads to rearrest by prolonging criminal court involvement and a sense of “permanent punishment.”

The imposition of fines has been viewed as a type of “state predation” in which courts seize the assets of those who become enmeshed in the criminal justice system, especially the poor and people of color; however, low levels of payment found in the study offer evidence against this view.

The authors concluded that abolition of fines and fees, as well as the relief of existing debt, would have little effect on crime but would eliminate the large but mostly ineffective bureaucracy tasked with collecting the debt. The elimination of these fines and fees would also erase one connection between criminalization and poverty.

Source: Criminalizing Poverty: The Consequences of Court Fees in a Randomized Experiment, American Sociological Association, 2022. Journals.sagepub.com/home/asr

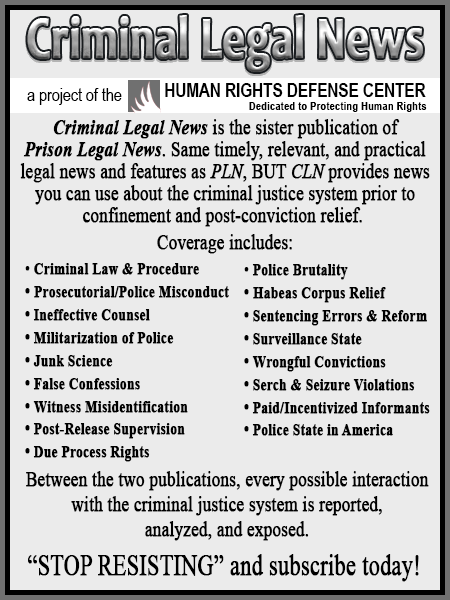

As a digital subscriber to Criminal Legal News, you can access full text and downloads for this and other premium content.

Already a subscriber? Login